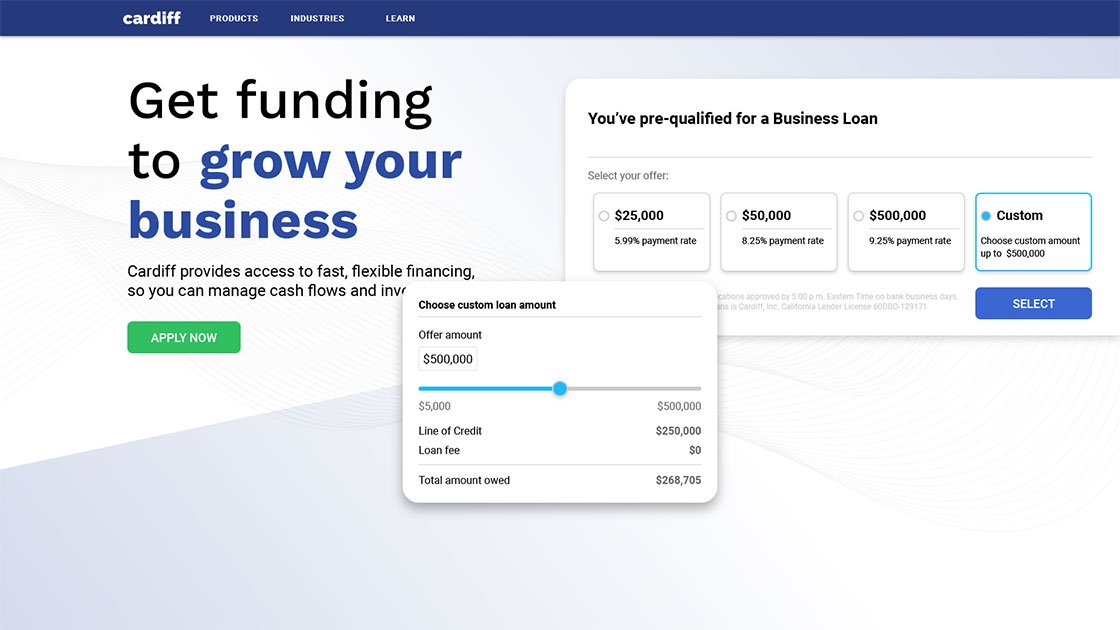

Small Business Loans

up to

$500K

Amount Funded

to Small Businesses

$8 Billion+

Application Process

only takes

5 minutes

Same day approval and funding

Unlock the potential of your business with our tailored small business loans. Get a business loan today that aligns with your goals and scales with your success.

Quick

Decisions

Fast-track your small business growth with loan approvals in minutes. We’re here to support your business’s journey.

Instant

Access

Once approved, access your funds promptly. With Cardiff, your business’s next big step is just a click away.

Adaptable

Terms

Our term business loans offer flexible repayment options, ensuring you can focus on what matters most: running your business.

Security

First

Cardiff employs top-tier encryption and cybersecurity measures to ensure that your personal data remains confidential.

How Our Small Business Loan Works

Select the optimal business loan tailored for your needs with Cardiff. We've streamlined our application, allowing you to concentrate on your business while we handle the heavy lifting.

Fast Online

Application

Get approved for Cardiff’s best small business loans by applying online. Experience a seamless process and get a decision in minutes.

Immediate

Funding

Once approved, receive the funds you need without delay. Cardiff’s accelerated process ensures your business can get the funds it needs promptly.

Revolving

Credit

Our term business loans mold to fit your business landscape, ensuring consistent financial backing at every juncture.

Adaptive

Financing

As your business grows and transforms, so do Cardiff’s small business loan options. Select from countless secured and unsecured business loan solutions.

How To Get a Business Loan with Cardiff

Get a business loan with Cardiff today. We guide you through every step, ensuring you understand how to make the most of your funds. Discover why Cardiff is America’s top choice for small business loans.

Small Business Loan Requirements

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

What you need to apply

- Basic details about you and your business

- Bank connection or bank statements for the past 3 months

- Business in good standing

Small Business Loan Requirements

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

What you need to apply

- Basic details about you and your business

- Bank connection or bank statements for the past 3 months

- Business in good standing

Hassle-Free

Application

Apply for a small business loan with minimal hassle. Our process is designed for your convenience.

Flexible

Terms

Cardiff’s term business loans offer the flexibility your business needs to thrive.

Best

Rates

Experience industry-leading experience and rates with Cardiff’s small business loans.

Transparent

Process

We believe in a straightforward approach. From application to approval, we’ll keep you informed at every step.

Small Business Loan FAQs

To qualify for a small business loan, applicants typically need at least a 600 credit score, an operational business for 12+ months, no bankruptcies in the past 3 years, and $20,000 in monthly revenue. Additionally, your business should be in good standing with your Secretary of State and be incorporated in the United States. To better tailor our financial solutions to your unique needs, we may occasionally request additional financial documents.

Navigating the world of small business loans can seem daunting, but with Cardiff, we aim to simplify the journey. The ease of approval largely depends on various factors, including your business’s financial health, credit score, and operational history. At Cardiff, we’ve streamlined our criteria and process to ensure a more straightforward and transparent approval journey. With our dedicated support and clear guidelines, securing a loan for your business’s growth has never been easier

In the dynamic world of business, every moment counts. At Cardiff, we recognize the importance of swift financial decisions. That’s why we’ve optimized our process to offer same day approvals for our small business loans. But we don’t stop there; once approved, we also ensure same day funding, enabling your business to capitalize on opportunities without delay. With Cardiff, you’re not just getting a loan; you’re getting a partner that values your time and ambition.

At Cardiff, we’ve set a benchmark to ensure we cater to a broad spectrum of businesses. A credit score of 600 is the foundational requirement for our business loans, striking a balance between accessibility and financial responsibility. In addition, our application process utilizes a soft credit pull, which does not impact your personal credit score.

At Cardiff, we understand that every business has unique financial needs. That’s why we offer both secured and unsecured small business loan options. A secured loan requires you to provide collateral, such as property or equipment, which can be claimed by us if the loan isn’t repaid. On the other hand, our unsecured business loans don’t require any collateral, offering flexibility without tying up your assets. Dive into Cardiff’s diverse loan offerings to find the perfect fit for your business’s financial journey.

Unsecured business loans, like those offered by Cardiff, provide businesses with the capital they need without requiring any collateral. Unlike secured loans, where assets such as property or equipment are pledged to back the loan, unsecured loans are based primarily on the borrower’s creditworthiness and business health. This means that businesses can access funds without tying up their assets. At Cardiff, we’ve streamlined our application process, ensuring businesses can swiftly apply and receive decisions, often on the same day. Our commitment is to offer flexible and accessible financial solutions, like our unsecured business loans, to support businesses at every stage of their journey.

At Cardiff, we understand the urgency businesses often face when seeking financial support. For our unsecured business loans, we’ve optimized our application and review processes to prioritize efficiency. As a result, we offer same day approvals and funding. Our aim is to ensure that businesses can swiftly access the funds they need, minimizing downtime and maximizing opportunities.

A small business loan from Cardiff is designed to offer flexibility and support to businesses in various stages of growth. You can utilize the funds for a multitude of purposes, including:

• Expanding operations or opening new locations.

• Purchasing inventory or new equipment.

• Hiring staff or funding payroll during peak seasons.

• Launching marketing and advertising campaigns.

• Covering day-to-day operational costs during cash flow gaps.

• Investing in research and development for new products or services.

• Renovating or upgrading business premises.

With Cardiff’s small business loans, you have the freedom to channel the funds where your business needs it most, ensuring sustainable growth and success.

Connecting your business checking account with Plaid™ allows us, as one of the top equipment finance companies, to streamline the application and verification process. It enables us to securely and quickly verify your business’s financial information, saving you time and effort. This connection ensures a seamless experience, allowing us to assess your eligibility and provide you with financing options efficiently.

Why choose Cardiff

• Transparent Rates

Our business loan rates start at 5.99%, ensuring you have a clear understanding of the costs involved.

• Nearly 20 Years of Experience

We have a proven track record, serving small businesses for nearly two decades.

• Trusted Partner

Count on our expertise, reliability, and personalized service to support your business goals.

Testimonials from business owners like you

*Cardiff can fund same day for applications approved by 5:00 p.m. Eastern Time on bank business days.