Cardiff, Inc.

California Lender License

60DBO-129171

Cardiff, Inc.

California Lender License

60DBO-129171

Same day approval and funding

Say goodbye to financial roadblocks. Boost your business with specialized merchant cash advance solutions from Cardiff, your go-to MCA Lender.

Lightning Fast

Decisions

Complete your application and get approved for an MCA in a matter of minutes. We’re committed to your business growth.

Funds at Your Fingertips

Once you’re approved, your merchant cash advance is just a click away. No waiting, no complications.

Customized Repayment Plans

Our merchant cash advance comes with flexible repayment options, so you can concentrate on what matters most—your business.

Top-Notch Security

Your data is sacred. We employ state-of-the-art security measures to protect your information.

Cardiff: Your Go-To MCA Lender

Select from a diverse array of merchant cash advance tailored to meet your business objectives. Let us, one of the leading merchant loan companies, navigate the financial intricacies, freeing you to concentrate on scaling your enterprise.

One-Stop

Application

Discover the perfect merchant cash advance option tailored to your business needs in just a few clicks.

Fast

Funding

Upon approval, receive your merchant cash advance funds promptly to advance your business goals.

Adaptable

Credit Options

Our MCA’s are as dynamic as your business, offering steadfast financial support when you need it most.

Scalable

Financing

Your business isn’t static, and neither are our merchant cash advance options. We adapt as you expand.

How Cardiff Makes Merchant Cash Advance Accessible

We make cash advance for business owners straightforward. From application to fund disbursement, we guide you at every step.

Merchant Cash Advance Eligibility Checklist

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

Application Essentials

- Basic details about you and your business

- Bank connection or bank statements for the past 3 months

- Business in good standing

Effortless Application Experience

Our MCA’s offer a range of repayment options, giving you the financial flexibility to succeed.

Flexible Repayment

Our small business financing options offer the adaptability your enterprise needs to flourish.

Market-Leading Rates

Benefit from highly competitive pricing when you opt for our merchant cash advance.

Transparent

Process

Trust in our commitment to transparency and a straightforward experience throughout your merchant cash advance journey.

Merchant Cash Advance FAQs

- To qualify for a Merchant Cash Advance (MCA) with Cardiff, you’ll need to meet the following criteria:

- Have been in operation for at least 12 months

- Be registered as a Corporation or LLC in the United States

- Generate a monthly revenue of $20,000 or more

- Have a credit score of 600 or above

- Provide an active bank connection through Plaid™

A merchant cash advance is a financial solution that provides immediate capital to business owners. Unlike traditional loans, an MCA is based on your business’s future credit card sales. This makes it a flexible funding option that adapts to your revenue flow.

A merchant cash advance works by providing you with a lump sum of capital upfront. In return, a percentage of your daily credit card sales is allocated to repay the advance. This structure offers flexibility, as the repayment amount adjusts based on your daily sales volume.

Securing a merchant cash advance with Cardiff is simple. Complete our streamlined online application, which takes less than 5 minutes. You’ll need to provide basic details about your business and connect your bank account for verification. Once submitted, you can expect a prompt approval.

A merchant cash advance offers the flexibility to use the funds for a variety of business needs. Whether it’s for inventory, equipment, expansion, or emergency expenses, an MCA provides the capital you need to keep your business running smoothly.

How to find merchant cash advance?

Finding the right MCA Lenders can be challenging, but Cardiff makes it easy. Our online application allows you to explore various merchant cash advance loans tailored to your business needs, all within a few minutes.

While both are forms of business financing, a traditional loan requires you to repay a fixed amount over a set period. A merchant cash advance, on the other hand, is repaid through a percentage of your daily credit card sales, offering more flexibility during periods of fluctuating revenue.

In contrast to many other lenders, your credit score remains unaffected when you apply for a merchant cash advance with Cardiff. We employ a soft credit inquiry to assess your credit standing without impacting your score.

Connecting your business checking account via Plaid™ allows us to accelerate the application and verification processes. This secure linkage enables quick and safe validation of your financial information, saving you time and effort. The seamless integration ensures an efficient assessment of your eligibility and timely presentation of your merchant cash advance options.

Why choose Cardiff

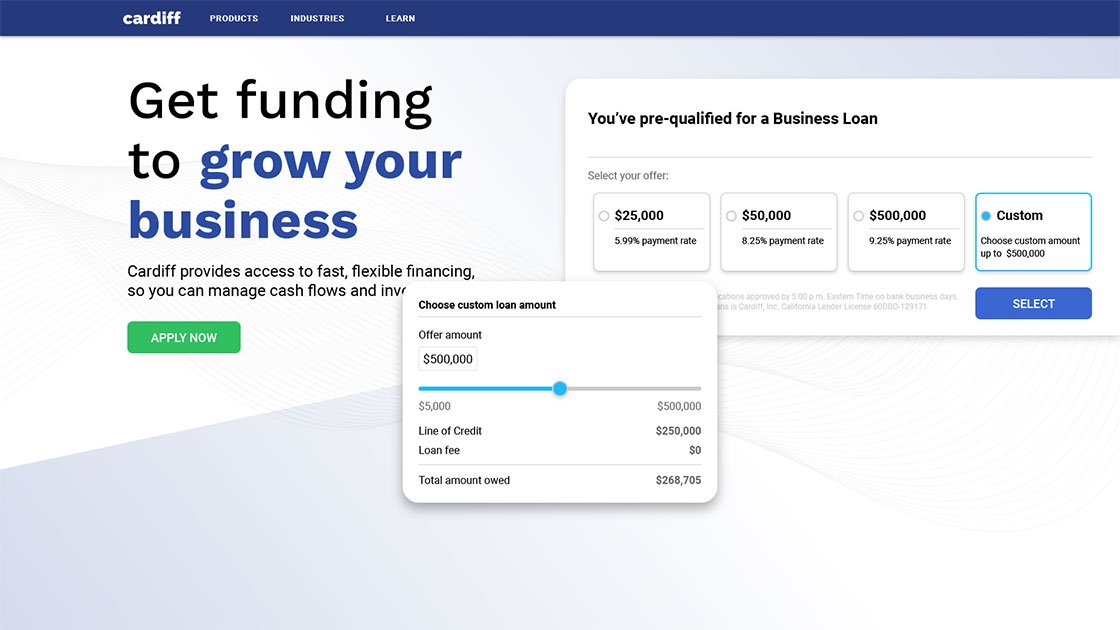

• Transparent Rates

Our business loan rates start at 5.99%, ensuring you have a clear understanding of the costs involved.

• Nearly 20 Years of Experience

We have a proven track record, serving small businesses for nearly two decades.

• Trusted Partner

Count on our expertise, reliability, and personalized service to support your business goals.

See what business owners like you have to say

*Cardiff can fund same day for applications approved by 5:00 p.m. Eastern Time on bank business days.