Cardiff, Inc.

California Lender License

60DBO-129171

Cardiff, Inc.

California Lender License

60DBO-129171

Get approved and funded same day

Enjoy the freedom of an unsecured business line of credit. With our business lines of credit, draw funds as needed and pay only for what you use.

Quick

Decisions

Get your business credit line approved within minutes. We understand time is vital for small businesses.

Instant

Access

Your small business line of credit is readily available whenever you need it. With Cardiff, financial support is just a click away.

Grow

With Us

Cardiff’s best business line of credit evolves as your business does. Get the right credit limit at any stage of your business journey.

Security

First

Apply for Cardiff’s unsecured business line of credit securely. We ensure your data is well-protected.

How Our Small Business Line of Credit Works

Draw funds, make repayments, and watch as your available small business line of credit replenishes with ease. Our application process is quick and simple. You can apply and receive a credit decision in just a few minutes.

Fast Online

Application

Start your journey with Cardiff’s unsecured business line of credit by applying online. Our streamlined process and straightforward business line of credit requirements mean you could get a decision in minutes.

Immediate

Funding

Once you’re approved for a small business line of credit, get the funds you need promptly. Cardiff’s line of credit business model is designed for quick disbursement, often putting money into your account within hours.

Revolving

Credit

Your available business credit line replenishes as you make repayments, providing continuous access to credit. This unique feature of our business line of credit ensures a steady flow to support your growth.

Adaptive

Financing

Cardiff’s best small business line of credit option evolves with your business, adapting the credit limit to meet your changing needs. Experience the benefits of a best business line of credit that grows with you.

How To Get a Business Line of Credit with Cardiff

Apply for the best business line of credit with Cardiff today. We provide helpful guides that show you how to apply and get started with a Cardiff Line of Credit. Plus, we offer tips on how to make the most of your funds. Experience why Cardiff is renowned for offering the best small business line of credit options for your small business needs.

Business Line of Credit Requirements

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

What you need to apply

- Basic details about you and your business

- Bank connection or bank statements for the past 3 months

- Business in good standing

Simple

Application

Apply for an unsecured business line of credit with just basic information about your business. Fulfilling our business line of credit requirements is as easy as 1, 2, 3.

Revolving

Credit

With Cardiff’s business lines of credit, your available credit replenishes as you repay, offering you continuous access to funds.

Best

Rates

Our business line of credit rates are industry-leading. At Cardiff, we prioritize your business’s financial health.

Pay for

What You Use

Cardiff offers the best small business line of credit where you only pay for what you use. No hidden costs or fees.

Small Business Line of Credit FAQs

A business line of credit or a business credit line is a flexible financing option that gives businesses access to a predetermined amount of money that can be used for any business-related expenses. Unlike a traditional loan, a business line of credit allows you to draw funds as needed, only paying interest on the amount used. Cardiff’s small business line of credit provides this flexibility and financial safety net to help businesses grow and thrive.

Obtaining a small business line of credit depends on several factors, including your credit score, business history, and revenue. At Cardiff, we strive to make the process as easy as possible, offering competitive business line of credit requirements and a quick application process.

The business line of credit requirements at Cardiff include a personal FICO credit score of at least 600, an operational business for 12+ months, no bankruptcies in the past 3 years, and $20,000 in monthly revenue. For the best business line of credit approval odds, your business should be in good standing with your Secretary of State and be incorporated in the United States.

Connecting your business checking account with Plaid™ allows us, as one of the top equipment finance companies, to streamline the application and verification process. It enables us to securely and quickly verify your business’s financial information, saving you time and effort. This connection ensures a seamless experience, allowing us to assess your eligibility and provide you with financing options efficiently.

For Cardiff’s business credit line or unsecured business line of credit, your business should have a monthly revenue of at least $20,000. This requirement ensures that your business has the necessary cash flow to manage the repayments of the line of credit for business.

At Cardiff, we understand the importance of maintaining a strong credit score. That’s why there are no hard credit pulls, meaning no impact on your personal credit score, in our approval process for a small business line of credit. With Cardiff’s business credit line, you can have peace of mind knowing that your personal credit score will not be affected during the application process.

At Cardiff, we value your time. Our best small business line of credit application process is designed for speed and efficiency, potentially providing a decision in as little as five minutes. Once approved, you can request funds from your business lines of credit and they could be in your account within hours. This swift approval process and competitive interest rates on business lines of credit make Cardiff a top choice for businesses.

To apply for a line of credit for business or business credit line with Cardiff, complete our online application form. We’ll ask for some basic information about you and your business. Our quick decision-making process means you could have a decision in as little as five minutes.

Ensure you meet these minimum business line of credit requirements:

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

A small business line of credit or business credit line functions as a financial cushion your company can lean on when necessary. With Cardiff’s business line of credit, you only pay for what you use, and your available credit line replenishes as you make repayments on your draws.

A business line of credit provides your business with greater flexibility, enabling growth opportunities and providing stability in case of unexpected expenses or seasonal fluctuations in revenue. You can use the funds to purchase more inventory or operations equipment, fund a new marketing campaign, open a new office or location, or support a new product launch.

To qualify for a Cardiff Line of Credit, you must have a personal credit score of at least 600.

Yes, you can apply for a Cardiff business Line of Credit as a corporation or LLC.

Once your small business line of credit is approved and you draw funds, they could be in your account within hours. We strive to provide the best business line of credit options, making it faster and easier for you to manage your finances effectively.

Why choose Cardiff

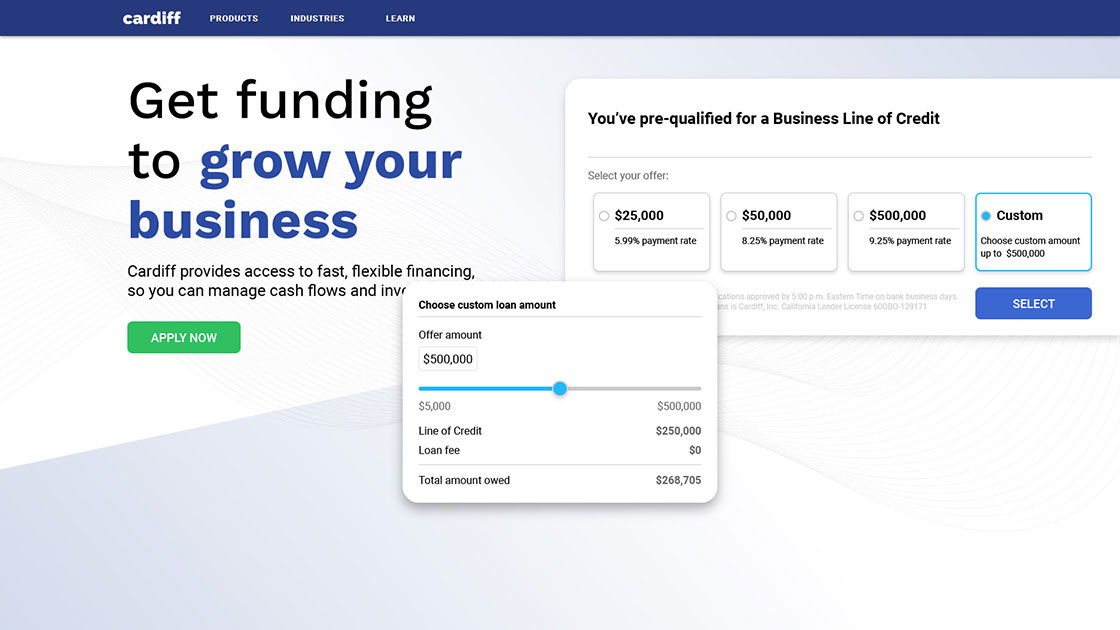

• Transparent Rates

Our business line of credit rates start at 5.99%, ensuring you have a clear understanding of the costs involved.

• Nearly 20 Years of Experience

We have a proven track record, serving small businesses for nearly two decades.

• Trusted Partner

Count on our expertise, reliability, and personalized service to support your business goals.

See what business owners like you have to say

*Cardiff can fund same day for applications approved by 5:00 p.m. Eastern Time on bank business days.