Cardiff, Inc.

California Lender License

60DBO-129171

Cardiff, Inc.

California Lender License

60DBO-129171

Get Approved and Funded Same Day

Elevate your business aspirations with our customizable business funding options. Secure the vital funds you need today and catapult your company to unparalleled heights.

Swift Approval

Process

Complete your application and discover how to get business funding in just a matter of minutes. We’re committed to fueling your expansion.

Instant Funding

Access

Once you’re approved, funding for your small business is merely a click away. No hold-ups, no complications.

Customizable

Repayment Plans

Our business funding options feature adaptable repayment schedules, freeing you to concentrate on what matters most—your business.

Uncompromising

Security

Your confidentiality is our priority. We employ top-of-the-line encryption and cybersecurity measures.

An Outline for Business Funding

Select from an array of small business funding alternatives that resonate with your business objectives. We manage the financial intricacies so you can zero in on scaling your business.

Hassle-Free Online

Application

Apply digitally and explore the small business funding solutions that are the perfect fit for your needs—all in a matter of minutes.

No-Delay

Funding

Once approved, the funding for your small business is just a few clicks away. Gain immediate access to the resources your business needs to thrive.

Adaptable

Credit Solutions

Our term-based business funding adjusts to your unique business environment, providing steadfast financial support at every turn.

Evolving

Funding Options

As your business flourishes, our small business funding solutions adapt to meet your ever-changing needs.

How to Secure Business Funding with Us

We simplify the process of how to get business funding. From the initial application to the disbursement of funds, we're with you every step of the way.

Eligibility Criteria for Business Funding

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

What you need to apply

- Basic details about you and your business

- Bank connection or bank statements for the past 3 months

- Business in good standing

Eligibility Criteria for Business Funding

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

What you need to apply

- Basic details about you and your business

- Bank connection or bank statements for the past 3 months

- Business in good standing

Simple

Application

Our application process for funding your small business is crafted for your ease and convenience.

Customizable

Repayment Solutions

Our business funding options provide the adaptability your operations require for sustained growth.

Competitive

Options

Take advantage of market-leading rates through our small business funding options.

Transparent

Process

We prize transparency and integrity. Rest assured, you’ll be fully informed throughout your business funding journey.

Business Funding FAQs

Small businesses can get business funding through our streamlined online application process. After filling out some basic details about your business, you can explore various small business funding solutions best suited for your needs—all within minutes. Once approved, funding for your small business is just a few clicks away.

To qualify for small business funding, you need to meet the following eligibility criteria:

- Your business must have been operating for at least 12 months.

- It should be registered as a Corporation or LLC within the United States.

- You must have a minimum of $20,000 in monthly revenue.

- A credit score of 600 or above is required.

- An active bank connection via Plaid™ is needed.

Our business funding options feature a swift approval process. You can discover how to get business funding in just a matter of minutes.

A credit score of 600 or above is required to acquire business funding through our platform.

The most common form of financing for a small business through our platform is term-based business funding, which offers adaptable repayment schedules and competitive rates.

Connecting your business checking account with Plaid™ is part of the eligibility criteria for business funding. It allows us to verify your financial status and monthly revenue quickly and securely, thereby streamlining the approval and funding process.

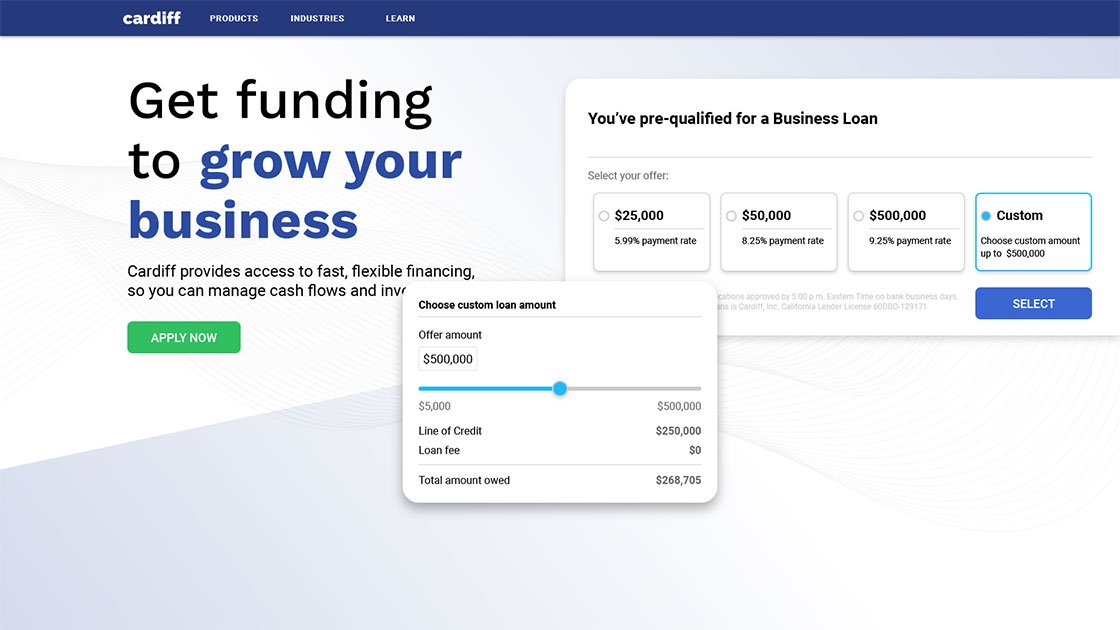

Why choose Cardiff

• Transparent Rates

Our business loan rates start at 5.99%, ensuring you have a clear understanding of the costs involved.

• Nearly 20 Years of Experience

We have a proven track record, serving small businesses for nearly two decades.

• Trusted Partner

Count on our expertise, reliability, and personalized service to support your business goals.

See what business owners like you have to say

*Cardiff can fund same day for applications approved by 5:00 p.m. Eastern Time on bank business days.