Cardiff, Inc.

California Lender License

60DBO-129171

Cardiff, Inc.

California Lender License

60DBO-129171

Same day approval and funding

Elevate your enterprise with our specialized business financing solutions. Secure the capital you need today to scale to new heights.

Lightning Fast

Decisions

Submit your application and receive your business financing approval in mere minutes. We’re your partner in growth.

Immediate

Access

Once approved, financing for your business is just a click away. No delays, no fuss.

Tailored

Repayment

Our business financing plans come with flexible repayment terms, allowing you to focus on your core operations.

Security

First

We prioritize your privacy with industry-leading encryption and cybersecurity protocols.

Our Business Financing Blueprint

Choose from a range of small business financing options that align with your business goals. We handle the financial complexities so you can focus on your business’s growth.

Streamlined Online

Application

Apply online and discover the small business financing options best suited for you, all within minutes.

No Waiting

Period

Upon approval, your business financing disbursement is just clicks away, ensuring fast access to the capital your business needs.

Flexible

Credit Options

Our term business loans mold to fit your business landscape, ensuring consistent financial backing at every juncture.

Dynamic

Financing

As your enterprise grows, our small business financing options evolve to meet your changing requirements.

How to Secure Business Financing with Cardiff

We make small business financing straightforward. From application to fund disbursement, we guide you at every step.

Eligibility Criteria for Business Financing

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

What you need to apply

- Basic details about you and your business

- Bank connection or bank statements for the past 3 months

- Business in good standing

Easy Application

Process

Our small business financing application process is designed for your convenience.

Flexible

Repayment Plans

Our small business financing options offer the adaptability your enterprise needs to flourish.

Competitive

Rates

Benefit from industry-leading rates with our small business financing options.

Transparent

Process

We value transparency and honesty. Rest assured, you’ll be kept in the loop throughout your business financing journey.

Business Financing FAQs

Getting financing for your business is a straightforward process with Cardiff. Simply complete our online application, which takes about 5 minutes. You’ll need to provide basic business information, and connect your bank account through Plaid™. Once your application is submitted, you can expect a quick approval, often within minutes.

To qualify for small business financing, you’ll need to meet the following criteria:

- Have been in operation for at least 12 months

- Be registered as a Corporation or LLC in the United States

- Generate a monthly revenue of $20,000 or more

- Have a credit score of 600 or above

- Provide an active bank connection through Plaid™

The “best” financing option for your business can vary depending on your specific needs, financial health, and business objectives. We offer a variety of business financing solutions, both secured and unsecured, each with flexible repayment terms. Our streamlined application process and quick approval times allow you to easily explore the small business financing options that would be most suitable for your enterprise.

There are two primary categories of business financing: unsecured and secured options. Unsecured financing is generally geared towards providing working capital for your business operations. This type of financing does not require collateral and is primarily based on your creditworthiness and the overall financial health of your business. On the other hand, secured financing is more oriented towards acquiring assets like equipment and requires you to provide collateral as security for the loan. At Cardiff, we recognize that each business has its own distinct financial requirements. For this reason, we provide a variety of small business financing options, including both secured and unsecured loans.

To accommodate a wide range of businesses, we’ve established a baseline credit score of 600 for our business financing options. This threshold aims to balance financial accessibility with fiscal responsibility. Additionally, our application process involves a soft credit inquiry, ensuring that your personal credit score remains unaffected.

By securely linking your business checking account through Plaid™, you enable us to expedite both the application and verification stages. We can safely, swiftly, and securely authenticate your business’s financial details, sparing you both time and hassle. This streamlined connection facilitates a smooth experience, allowing for efficient evaluation of your eligibility and prompt presentation of your small business financing options.

Understanding the immediate financial needs that businesses often encounter, we’ve streamlined our application and review process for business financing to be highly efficient. As a result, we are able to offer immediate approvals and same day fund disbursements. Our goal is to minimize any operational interruptions, allowing your business to quickly access the necessary funds and seize emerging opportunities.

Why choose Cardiff

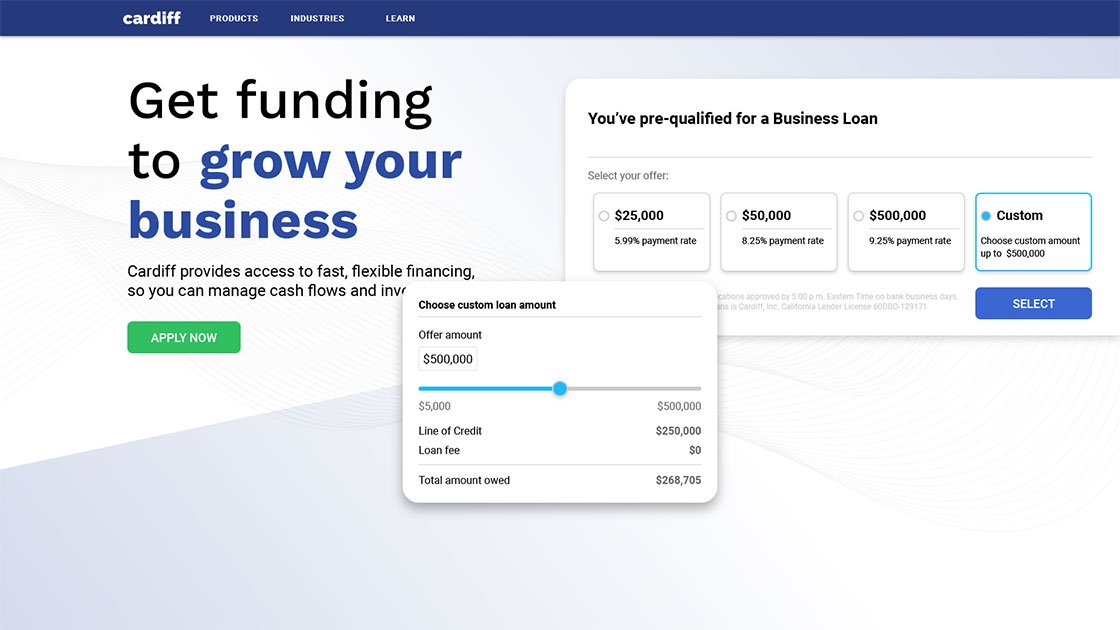

• Transparent Rates

Our business loan rates start at 5.99%, ensuring you have a clear understanding of the costs involved.

• Nearly 20 Years of Experience

We have a proven track record, serving small businesses for nearly two decades.

• Trusted Partner

Count on our expertise, reliability, and personalized service to support your business goals.

See what business owners like you have to say

*Cardiff can fund same day for applications approved by 5:00 p.m. Eastern Time on bank business days.