Cardiff, Inc.

California Lender License

60DBO-129171

Cardiff, Inc.

California Lender License

60DBO-129171

What are SBA Loans?

SBA Loans are government-backed loans designed to provide financial assistance to small businesses. They are facilitated by approved SBA Lenders and aim to offer lower interest rates and flexible Terms on SBA Loan agreements.

Swift Decision-Making

Submit your application and receive a decision swiftly, allowing you to focus on growing your business.

Immediate Fund Access

Upon approval, your funds become immediately accessible with just a few clicks, free of any delays or obstacles.

Tailored Payment Options

Enjoy repayment plans that adapt to your business needs, letting you concentrate on your core operations.

Empowering Your Choices

With a variety of financial solutions, you have the freedom to steer your business in the direction you choose.

Your Go-To Lender for Business Funding

Select from a diverse array of financing solutions tailored to meet your business objectives. We navigate the financial intricacies, freeing you to concentrate on scaling your enterprise.

All-in-One

Application

Discover the perfect merchant cash advance option tailored to your business needs in just a few clicks.

Faster

Funding

Once approved, your funds are promptly released, enabling you to advance your business goals efficiently.

Flexible Financing

We offer a range of loan options that flex to fit your business’s unique financial landscape.

Evolving

Support

As your business grows, our financing solutions scale to meet your changing needs.

Requirements and Qualifications for SBA Loans

The Requirements for SBA Loan and Qualifications for SBA Loans can vary widely depending on the type of loan and the lender. Generally, you'll need to have been in business for a certain number of years, meet revenue requirements, and have a good credit score. Some loans, like the SBA 7(a), have specific eligibility criteria that may include the use of the loan funds and the nature of your business.

Small Business Financing Eligibility Checklist

- Operating for 12+ months

- Incorporated as a Corporation or LLC in the United States

- $20,000 in monthly revenue

- 600+ credit score

- Active bank connection (Plaid™) or statements from the last 3 months

Application Essentials

- Basic details about you and your business

- Bank connection or bank statements for the past 3 months

- Business in good standing

Simplified Application Journey

Our business loans include a range of repayment options, giving you the financial flexibility to succeed.

Adaptive

Payment Solutions

Cardiff’s financing options offer the adaptability your enterprise needs to flourish.

Competitive

Pricing Advantage

Enjoy industry-leading rates when you choose our tailored business financing options.

Open and Honest

Process

We emphasize clear communication and transparency at every step of your financing journey.

Small Business Administration Loan FAQs

An SBA loan is a type of business financing that is guaranteed by the U.S. Small Business Administration. These loans are issued by approved SBA lenders and are designed to offer competitive terms and rates to help small businesses grow.

The SBA Express Loan is generally considered the easiest SBA loan to qualify for. It offers a streamlined application process and quicker approval times, although it typically has a lower maximum loan amount compared to other SBA loan types.

The amount of money you need to secure an SBA loan varies depending on the type of loan and your business needs. However, SBA loans can range from small amounts to as much as $5 million.

The SBA itself does not give you money; it guarantees the loan provided by the lender. The amount you can borrow depends on various factors including your business needs, creditworthiness, and the specific SBA loan program you choose.

Obtaining an SBA loan can be a good idea for many businesses due to the competitive interest rates and flexible repayment terms. However, it’s important to carefully assess your business’s financial situation and consult with a financial advisor to determine if it’s the right option for you.

The credit score requirements for an SBA loan can vary by lender and loan type, but generally, a credit score of 680 or higher is preferred.

While SBA loans offer various benefits, they can often take weeks or even months for approval and disbursement. If your business needs capital more quickly, Cardiff provides compelling alternatives. One of Cardiff’s key advantages is the speed at which we can provide funding. We specialize in same-day approvals and funding, enabling you to access the capital you need almost immediately.

Not everyone will qualify for an SBA loan. Eligibility criteria can include your business’s age, its financial health, your credit score, and the specific requirements of the SBA loan program you’re applying for.

The time it takes to get an SBA loan can vary widely depending on the type of loan and the lender. Some SBA Express Loans can be approved in a matter of days, while more complex loans like the SBA 7(a) may take several weeks or even months for approval and disbursement.

Connecting your business checking account with Plaid™ allows us, to streamline the application and verification process. It enables us to securely and quickly verify your business’s financial information, saving you time and effort. This connection ensures a seamless experience, allowing us to assess your eligibility and provide you with financing options efficiently.

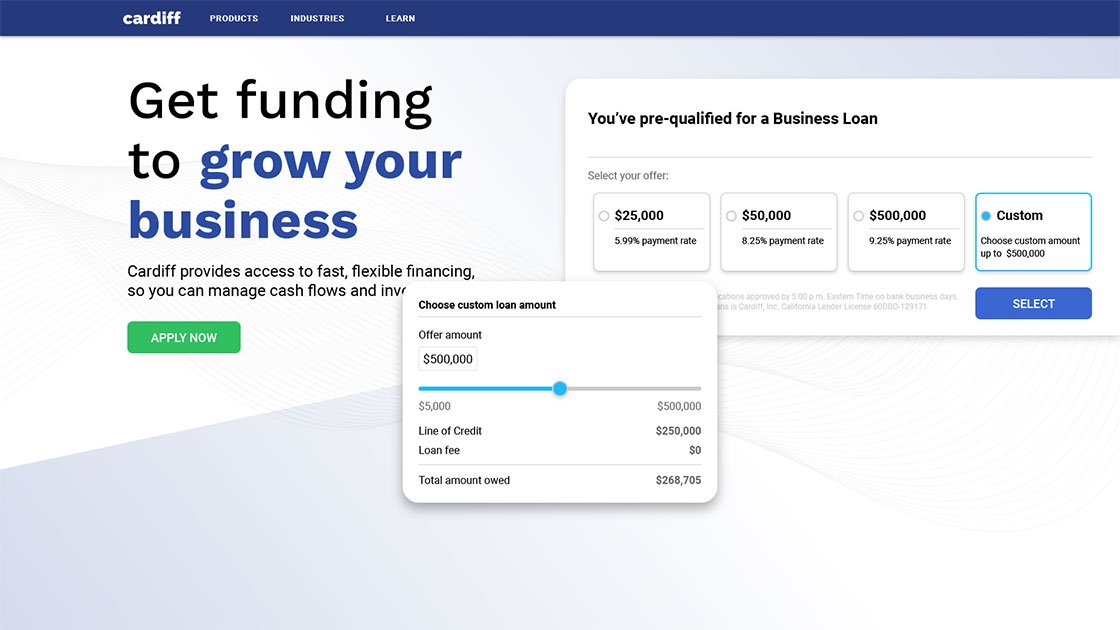

Why choose Cardiff

• Transparent Rates

Our business loan rates start at 5.99%, ensuring you have a clear understanding of the costs involved.

• Nearly 20 Years of Experience

We have a proven track record, serving small businesses for nearly two decades.

• Trusted Partner

Count on our expertise, reliability, and personalized service to support your business goals.

See what business owners like you have to say

*Cardiff can fund same day for applications approved by 5:00 p.m. Eastern Time on bank business days.